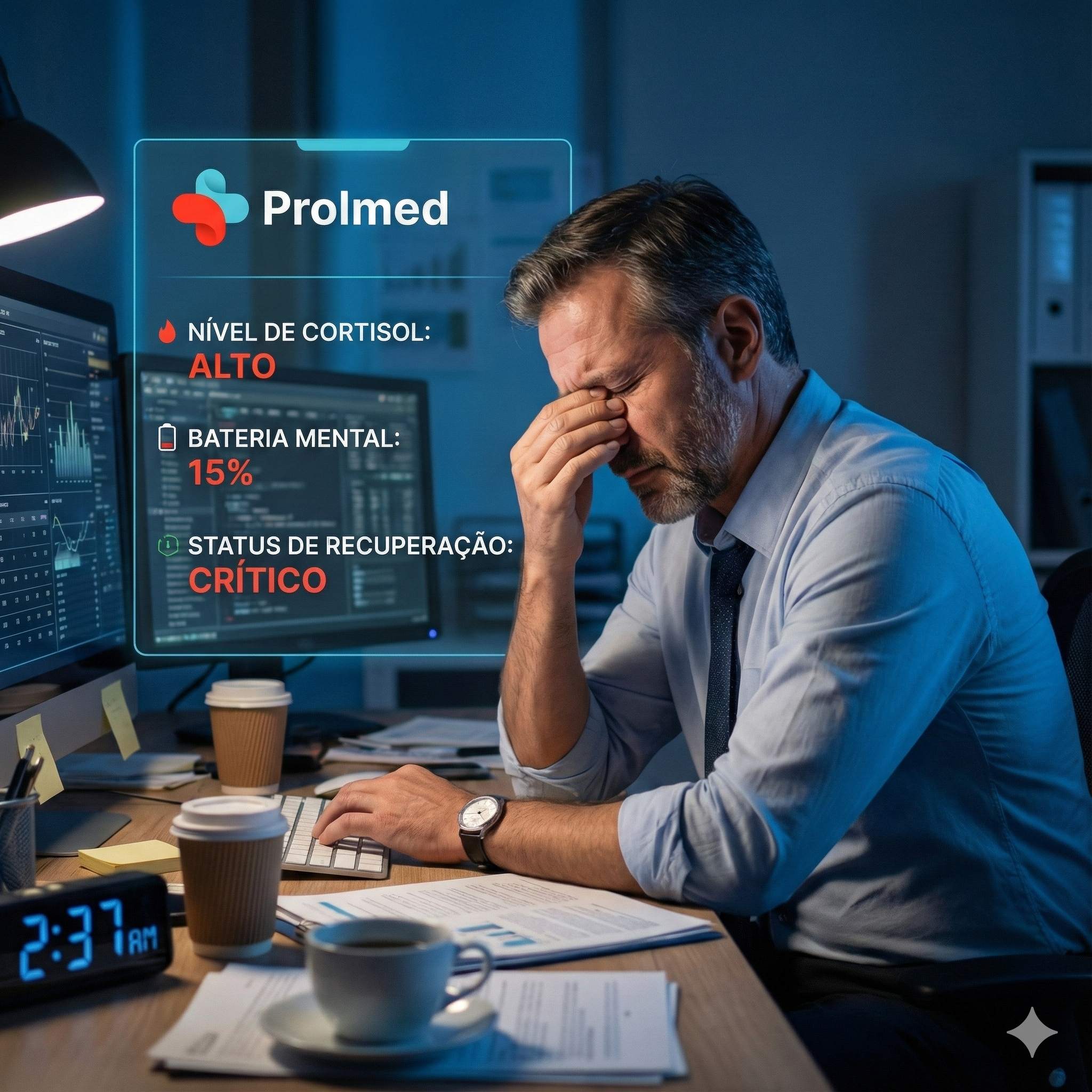

Recentemente, a exaustão psicológica, a quantidade insuficiente de foco, o sono ruim e o burnout tornaram-se significativamente populares, Em particular entre especialistas do setor que lidam com significativas demandas e pressão regular. Em localidades como Manaus, Amazonas, onde o uso de tratamento especializados de saúde geral mental poderia ser confinado, respostas eletrônicas revolucionárias são importantes. A Prolmed surge como uma plataforma líder de telemedicina devotada a saúde geral psicológica, clareza e funcionalidade sustentável, disponibilizando cuidado alicerçado em ciência, humanizado e absolutamente digital. A Prolmed não é apenas apenas outro empresa de telemedicina. Sua missão principal é tratar as bases fundamentais da fadiga psicológica, da ansiedade, do TDAH, do burnout e dos doenças do dormir, ao invés de simplesmente mascarar indicações. Através de uma estratégia assistencial estruturada e customizada, a sistema conecta pacientes a doutores credenciados que se especializam em saúde e qualidade de vida psicológica e efetividade cognitivo, assegurando terapia confiável, privado e produtivo. Um dos importantes diferenciais da Prolmed é seu protocolo guiado. Todo pessoa dá início a sua jornada monitorando sintomas através de um questionário pela internet projetado para avaliar a exaustão mental, problemas de atenção, o estabilidade emocional e a qualidade do descanso. Essa avaliação inicial auxilia que os profissionais de saúde se preparem para uma consulta mais precisa e significativa, permitindo que compreendam a agenda de todo indivíduo, seus desafios e seu história de saúde anterior à primeira consulta. A análise clínica é conduzida via teleconsulta com profissionais médicos que mantêm registros CRM válidos e atuam em completa conformidade com as regras do CFM. Essas consultas não são apressadas ou superficiais. A Prolmed valoriza a escuta compassiva, assegurando que os clientes se sintam escutados, compreendidos e apoiados em todo o seu tratamento. Esse modelo de atendimento humanizado resultou em taxas de contentamento dos indivíduos acima de 94%, refletindo confiança e resultados consistentes. Em seguida à sessão, os indivíduos recebem um plano de tratamento totalmente customizado. Dependendo de necessidades individuais, esse plano poderia conter abordagens de otimização do repouso, ajustes no forma de viver, exames clínicos e remédios quando necessário. O propósito é restaurar a clareza psicológica, fortalecer o estabilidade emocional e elevar a produtividade sem empurrar os pacientes em direção à exaustão ou à dependência de alternativas de curto tempo. Um adicional destaque da Prolmed é o seguimento constante. Em vez de uma apenas uma sessão, clientes aproveitam acompanhamento contínuo, check-ins programados e suporte por chat assíncrono para clarificar incertezas durante consultas. Essa interação constante faz com que os terapias sejam adaptados em tempo atual, maximizando a performance e os resultados de estendido prazo. A plataforma atende uma ampla gama de pessoas, tais como executivos, empreendedores, profissionais da área da saúde médica, e universitários que enfrentam cansaço persistente, insuficiência de concentração, baixa produtividade, ou sobrecarga emocional. Diversos indivíduos relatam progressos consideráveis em semanas. Segundo dados da Prolmed, 89% experimentam melhora da clareza psicológica dentro de 30 dias, noventa e dois% relatam melhor nível de descanso, 87% tornam-se ainda mais eficientes, e 91% sentem-se emocionalmente mais estáveis. Com cerca de dois,500 pessoas atendidos em todo o Brasil e acima de cinco anos de experiência em telemedicina de saúde psicológica, a Prolmed construiu uma robusta reputação em tratamentos fundamentados em evidências. Relatos ressaltam mudanças da vida verdadeira, incluindo a recuperação da energia em somente 3 semanas, a duplicação da eficiência em um mês, e a superação do burnout em seis semanas por meio de suporte clínico contínuo. A Prolmed também prioriza a confidencialidade e a proteção. Todas as consultas e informações são cem% privadas, assegurando que os usuários sintam-se protegidos ao longo de o seu acompanhamento. A plataforma foi projetada para valorizar o tempo dos usuários, disponibilizando agendamentos flexíveis e eliminando o estresse do deslocamento ou das filas de espera. Dentro de um ambiente onde a sobrecarga psicológica tornou-se a norma, a Prolmed apresenta uma alternativa clara: telemedicina orientada pela ciência, compassiva, voltada para performance sustentável e boa-estar. Para as pessoas exauridos de acordar cansados, lutando para focar, ou sentindo-se travados no burnout, a Prolmed oferece um trajeto estruturado em direção a clareza psicológica, equilíbrio, além de uma forma mais equilibrada de trabalhar—sem envolver autodestruição. médico para performance no trabalho